Gross Annual Income Amount Meaning

Want to learn more. If you run a business its vital to know how to calculate and use gross income.

What Is Gross Vs Net Income Definitions And How To Calculate Mbo Partners

Her gross annual income was 50000.

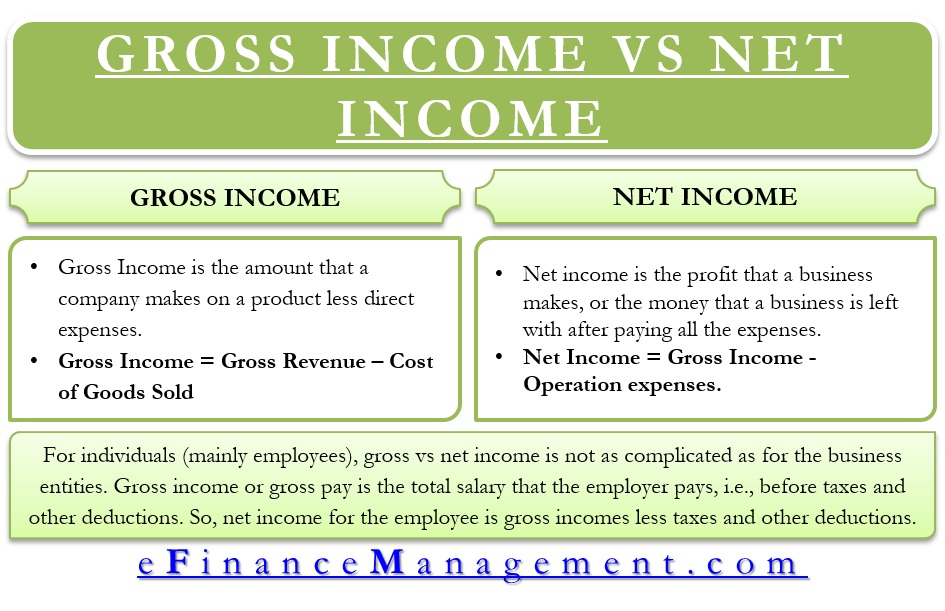

Gross annual income amount meaning. 1 For companies gross income is interchangeable with gross margin or. Gross income for individuals From a wage earners perspective gross income is money earned before things like taxes or other deductions are taken out. Income Tax Act 1961 defines both the terms as follows.

Gross income is all income from all sources that isnt specifically tax-exempt under the Internal Revenue Code. Gross annual income refers to all earnings before any deductions are made and net annual income refers to the amount that remains after all deductions are made. Gross income is a significant figure because its the foundation for many other financial calculations that give insight into a companys financial health.

For example when an employer pays you an annual salary of 40000 per year this means you have earned 40000 in gross pay. Gross salary can be defined as the amount of money paid to an employee before taxes and deductions are discounted. Taxable income starts with gross income then certain allowable deductions are.

Business gross income is a companys total income from all sources before subtracting taxes and other expenses. Gross salary is determined by the employer when the job is offered. Measom mentions that annual gross income is a persons yearly salary before deductions are made.

Gross pay is the total amount of money an employee receives before taxes and deductions are taken out. Some companies may ask for annual gross income. Gross annual income is the amount of money a person earns in one year before taxes and includes income from all sources.

Gross Annual Income is The total amount of income earned expressed as an annual figure versus hourly or bi-weekly before taxes. Avoid using the Net Pay portion of the paycheck because this includes deductions from taxes and medical insurance. Understanding gross pay vs.

Gross income includes any wages properties or services received before taxes and deductions. It refers to the annual sum or monthly sum that an employee earns in the course of his job position. What Qualifies as Income.

Gross income which is also known as gross pay before tax pay or pre-tax income is the income that an individual makes before taxes. Credit card companies usually prefer to ask for net income because that is what you have available with which to pay your monthly payment. Improve your vocabulary with English Vocabulary in Use from Cambridge.

What Does Gross Salary Mean. Annual gross income is your income before anything is deducted. You can usually find gross income as a line on a paycheck or W-2.

The concept applies to both individuals and businesses in preparing annual tax returns. The total amount of a persons or organizations income in a one-year period before tax is paid on it. Gross annual income is the amount earned by businesman in one financial year before income tax is to be calculated it includes income from all heads of incomelike house property 2busines income 3agriculture income 4 income from other sources like shares bank interest 5 income from professionbefore vl a deduction S 80cc and others.

Gross salary is the total amount of money that is given to an employee as salary or wages before any taxes or deductions are cut from their paycheck. For example when an employer pays you an annual salary of 50000 per year this means you have earned 50000 in gross pay. How often a person gets paid and the amount determines annual gross income.

Gross pay is the total amount of money an employee receives before taxes and deductions are taken out. Section 80B 5 of the IT Act defines Gross Total Income Includes income received or receivable by you in the previous year adjusted for clubbing and carry-forward amounts from previous years Deduct the non-taxable parts of your income from this amount to estimate Gross Total Income. It is the gross monthly or annual sum earned by the employee.

4 Ways To Calculate Annual Salary Wikihow

What Is Gross Income For A Business

How Do Earnings And Revenue Differ

Operating Income Vs Gross Profit

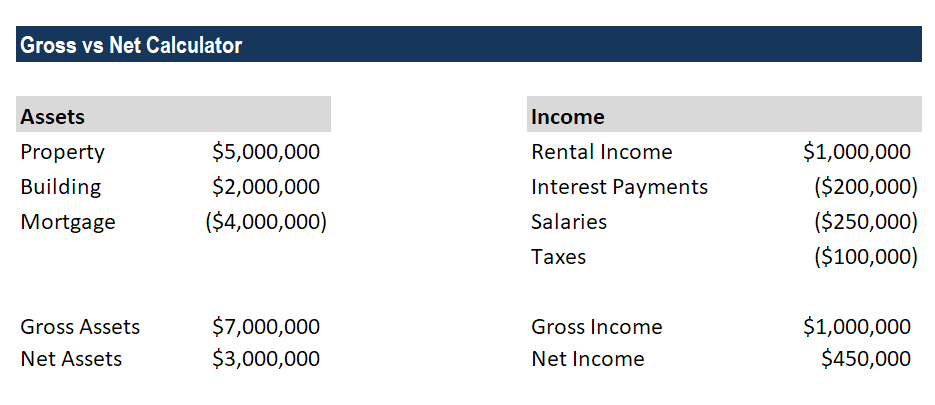

Gross Vs Net Learn The Difference Between Gross Vs Net

Gross Income Definition Formula Examples

Gross Annual Income Calculator

What Income Level Is Considered Rich Financial Samurai

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Annual Income Learn How To Calculate Total Annual Income

Gross Vs Net Learn The Difference Between Gross Vs Net

Gross Income Formula Step By Step Calculations

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Difference Between Gross Income Vs Net Income Definitions Importance

What Is Base Salary Definition And Ways To Determine It Snov Io

The Difference Between Gross And Net Pay Economics Help

Post a Comment for "Gross Annual Income Amount Meaning"