Japan Monthly Income Tax Calculator

Japan income tax calculator monthly. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts.

Real Estate Related Taxes And Fees In Japan

If you wish to enter you monthly salary weekly or hourly wage then select the Advanced option on the Japanese tax calculator and change the Employment Income and Employment Expenses period.

Japan monthly income tax calculator. Youll then get a breakdown of your total tax liability and take-home pay. Because its creating a monthly budget itll work fine if youre not a teacher but youll need to adjust some fields. The Payroll Calculator estimates net salary payment across 2 scenarios.

This tool will help you answer the question. How much can I earn and save teaching English in Japan. Monthly payroll calculations in Japan include monthly salary overtime commuting and other allowances social insurance contributions and taxes.

Calculate your take home pay that s your salary after tax with the japan salary calculator. Results do not represent actual withholdings as per Japanese tax law. Job status age prefecture and work industry affects social insurance and dependents affect income taxes.

30 rows National tax. Using the japan tax calculator you can get an idea of the amount of taxes you might have to pay. It is advised that you consult with us for an accurate result.

See how we can help improve your knowledge of Math Physics Tax Engineering and more. If you wish to enter you monthly salary weekly or hourly wage then select the Advanced option on the Japanese tax calculator and change the Employment Income and Employment Expenses period. The real amount of this tax is actually the double of this but your company is paying for it.

One of a suite of free online calculators provided by the team at iCalculator. It s not like for every 100 yen. Insurance is 495 of your salary and pension is 915 of your salary.

The Japan Income Tax Calculator uses income tax rates from the following tax years 2020 is simply the default year for this tax calculator please note these income tax tables only include taxable elements allowances and thresholds used in the Japanese Annual Income Tax Calculator if you identify an error in the tax tables or a tax credit threshold that you would like us to add to the tax calculator. Japan s progressive tax system japan uses a progressive income tax system. This places Ireland on the 8th place in the International Labour Organisation statistics for 2012 after United Kingdom but before France.

You can get this final amount back as well but it will require some extra effort and a helpful friend. The average monthly net salary in the Republic of Ireland is around 3000 EUR with a minimum income of 1600 EUR per month. COST OF LIVING IN JAPAN.

The Japanese tax calculator assumes this is your annual salary before tax. Your Total Income After Tax Simply enter your annual or monthly income into the salary calculator above to find out how taxes in Japan affect your income. The taxation in Ireland is usually done at the source through a pay-as-you-earn PAYE system.

This will state both your payment amount and the amount of income tax paid. Your taxable income after the basic deduction is 3000000 yen 3380000 380000. Thats right income tax.

This leaves 1050000 yen in taxable income 3000000 1950000 1050000. The Japanese tax calculator assumes this is your annual salary before tax. The Japanese government will still withhold 2042 percent of your lump-sum payment for income tax the standard deduction for income paid overseas.

It is simply 16410Y month so 196920Y year. Income Tax Calculator for individuals This is another Japan Tax calculator that will help you understand how much Japanese National Income tax shotokuzei 所得税 Local tax Also known as residents tax juminzei 住民税 social health insurance and pension contributions you will have to pay depending on your annual salary. It s not.

The impact of taxation and any tax reliefs depends on individual circumstances. This categorization is not related to visa types. If it is your first year in Japan you will pay an average of 50000Y.

The income tax calculation is based on your taxable income minus the standard personal deduction which is equal to 380 000y. Japan income tax calculator monthly. Results are based on.

The average monthly net salary in japan jp is around 430 000 yen with a minimum income of around 130 000 yen per month. Important Notes the results from this calculator should be used as an indication only. For tax calculation purposes in Japan youll need to report income from your salary along with any benefits or bonus payments that you receive.

The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. The next 1950000 yen of income will go into the 5 bucket and will cost 97500 yen in taxes 1950000 x 5 97500. If you get non-monetary benefits as part of your job for example if your employer provides you a house to live in this will also be treated as taxable income.

Income tax return income tax income tax is paid annually on income earned during a calendar year. Review the latest Japanese income tax rates and thresholds to allow calculation of salary after tax when factoring in health insurance contributions pension contributions and other salary taxes in Japan.

Real Estate Related Taxes And Fees In Japan

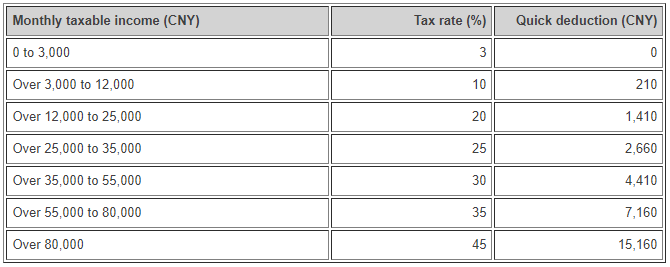

Income Tax In China Teaching Nomad

Japan Salary Calculator 2021 22

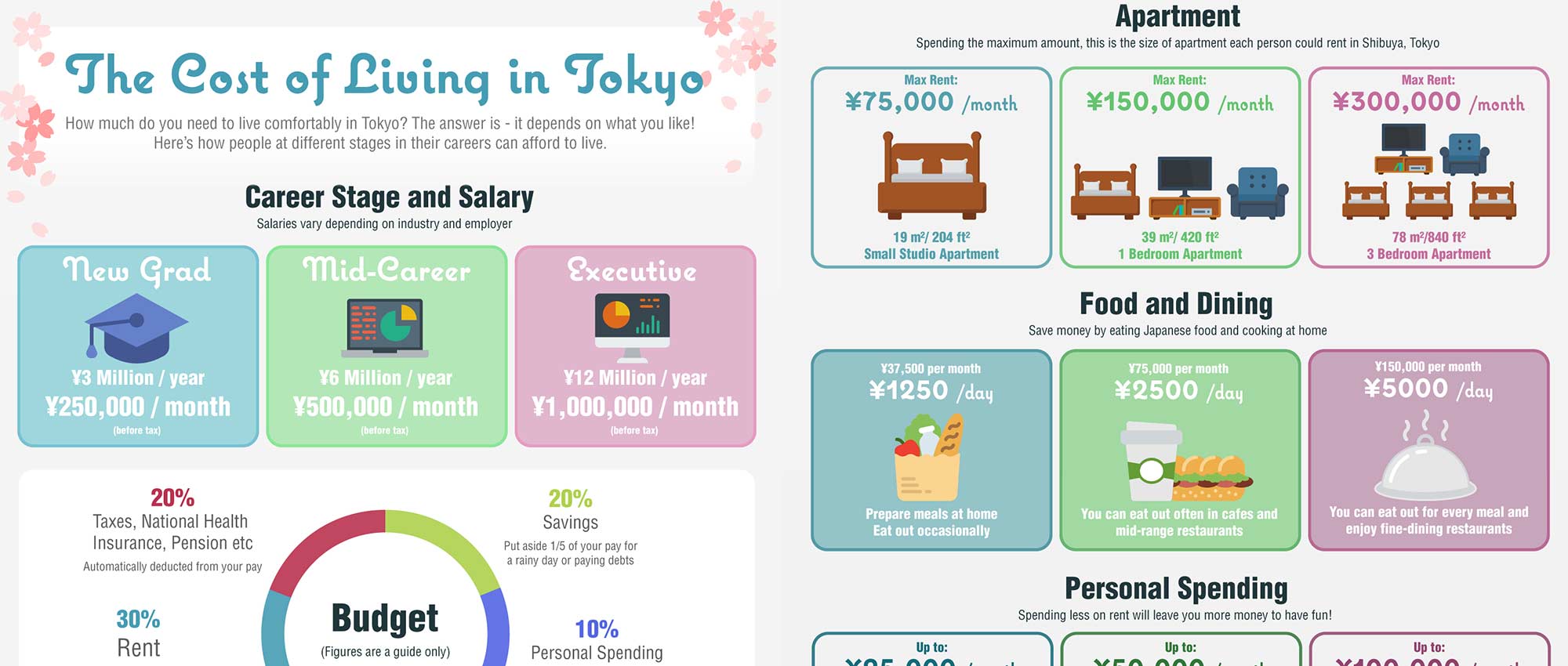

How Much You Need To Live Comfortably In Tokyo Infographic Apts Jp

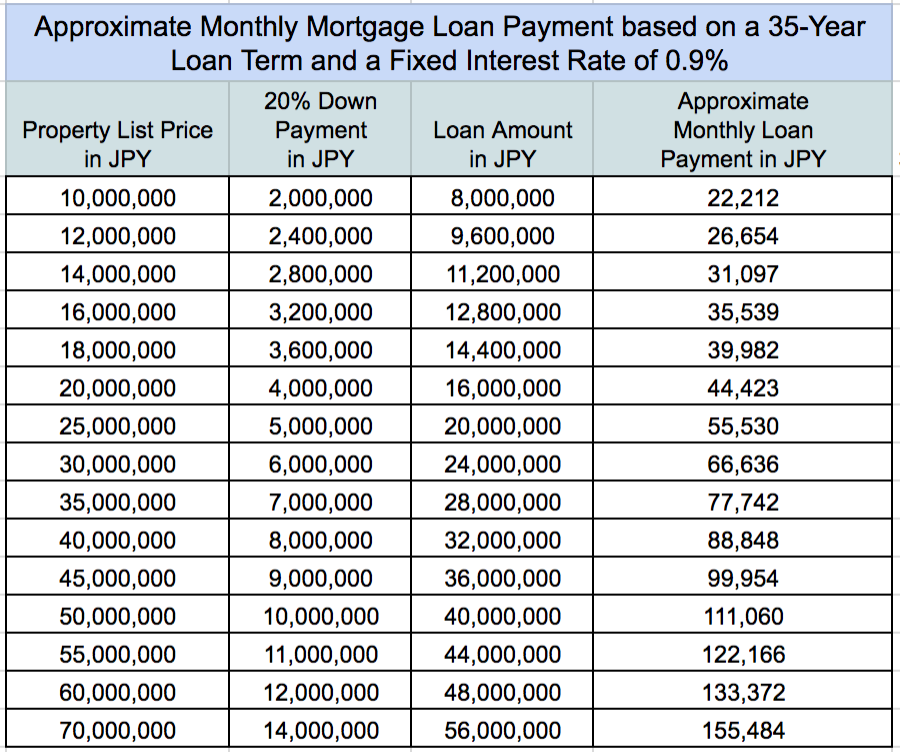

Yen Mortgage Loan Calculator How Much Can You Afford To Buy In Japan Blog

Japanese Salary Systems Salary Guide And Calculation Method G Talent Blog

New Tax Law Take Home Pay Calculator For 75 000 Salary

What Is Juminzei Resident Tax And Nenkin National Pension Plan For International Staff Tokyo University Of Foreign Studies

What Is The Average Annual Salary Bonus In Japan Blog

New Tax Law Take Home Pay Calculator For 75 000 Salary

Real Estate Related Taxes And Fees In Japan

![]()

Year End Tax Filing In Japan English Speaking Services For Foreigners

A Quick Guide To Taxes In Japan Gaijinpot

How To Calculate Foreigner S Income Tax In China China Admissions

Average Salary In Japan 2021 The Complete Guide

Individual Income Tax Return Filing In Japan For Foreigners Latest 2020 2021 Shimada Associates

How To Calculate Foreigner S Income Tax In China China Admissions

Real Estate Related Taxes And Fees In Japan

Yen Mortgage Loan Calculator How Much Can You Afford To Buy In Japan Blog

Post a Comment for "Japan Monthly Income Tax Calculator"