Monthly Income Calculator Alberta

Our Mortgage Affordability Calculator applies the federal lending rules most lenders use in assessing mortgage. Use this Alberta Child Support Calculator to calculate child support for sole shared and split custody parenting.

How To Calculate Canadian Payroll Tax Deductions Guide Youtube

Maximum of 3600 Line 11300 - Old Age Security.

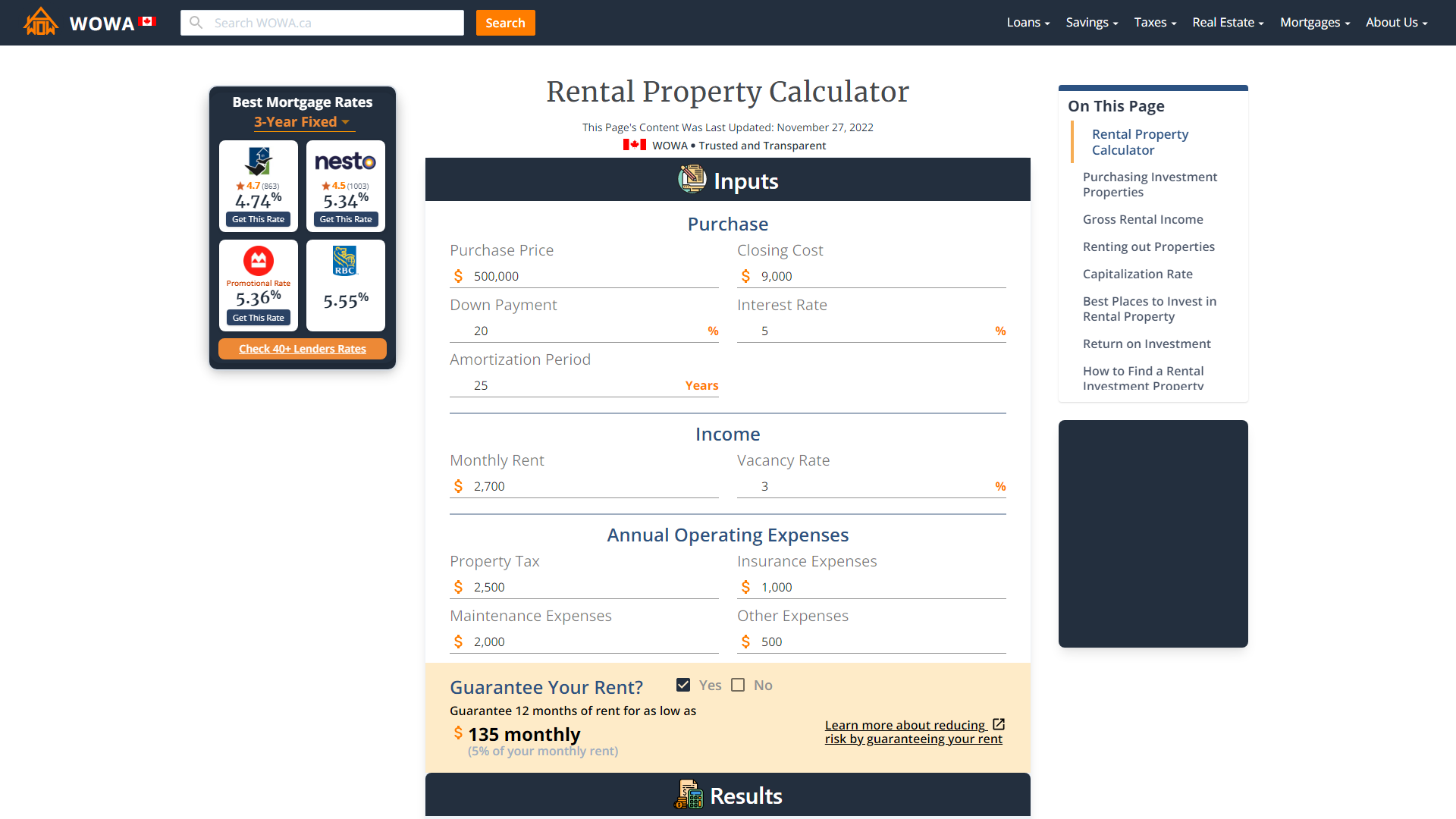

Monthly income calculator alberta. Simplepay includes Direct Deposit Electronic Remittances Statutory Holiday Calculator Timesheets Custom Earning Deductions General Ledger Import All CRA forms T4T4ARL1ROE. Gross Rental Income Monthly Rent 12 months 1 - Vacancy Rate100 The vacancy rate is the amount of time your property is empty and not making money. This usually happens in late January.

Then I dug into each business to determine its financial health and growth potential. To get the most accurate result make sure to indicate all of the figures for your monthly expenditures. Alberta Mortgage Calculator Location Please ensure your location is correct in order to find the best rates available in your area.

The calculator will show your tax savings when you vary your RRSP contribution amount. The post Earn 35160 Rental Income Monthly Without Owning a Property appeared first on The Motley Fool Canada. Our retirement calculator takes into account the average Canadian retirement income from the Old Age Security OAS and Canada Pension Plan CPP for 2018.

Total Income Distribution Visualize how your combined income could be distributed showing net income tax benefits and BC. See how we can help improve your knowledge of Math Physics Tax Engineering. Income remaining after considering tax BC.

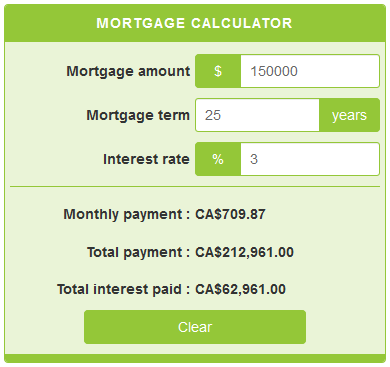

Simplepay Tax Calculator is a free online tool to calculate Canada Payroll taxes and print cheques. Minimum annual gross 72000. Our mortgage calculator contains Alberta current mortgage rates so you can determine your monthly payments.

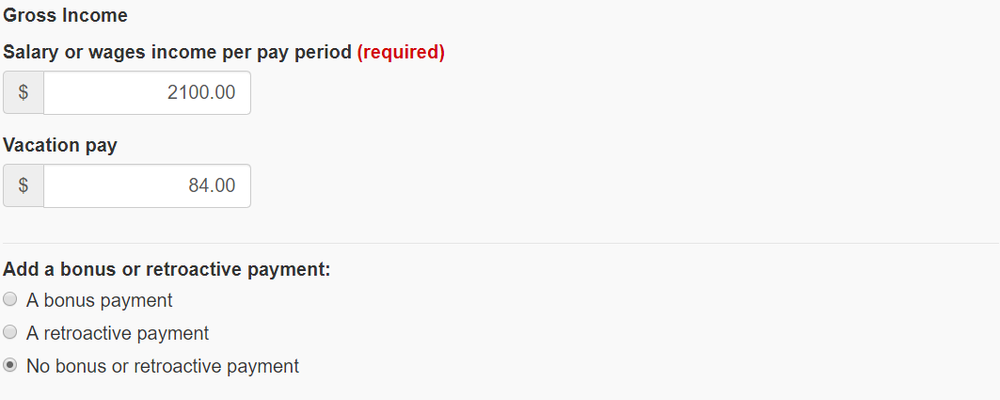

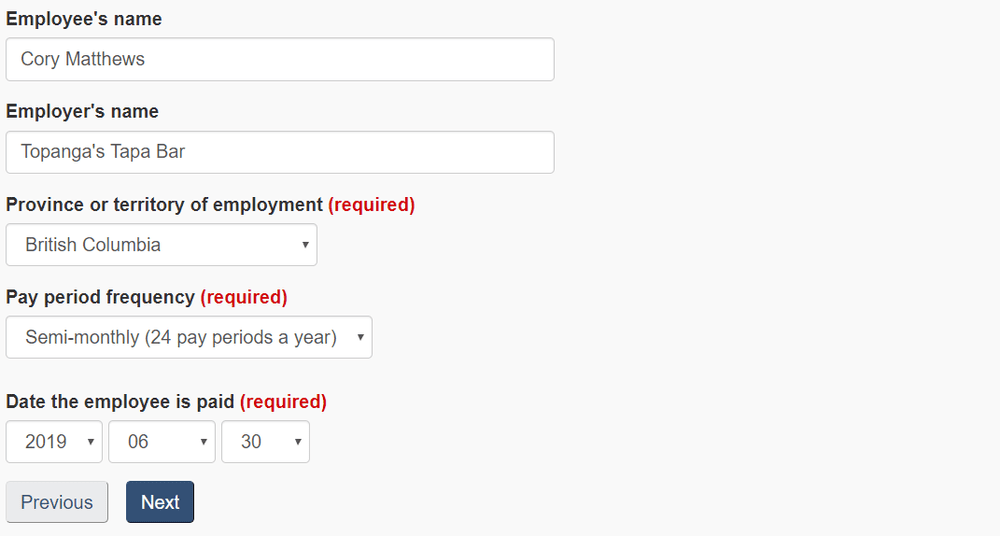

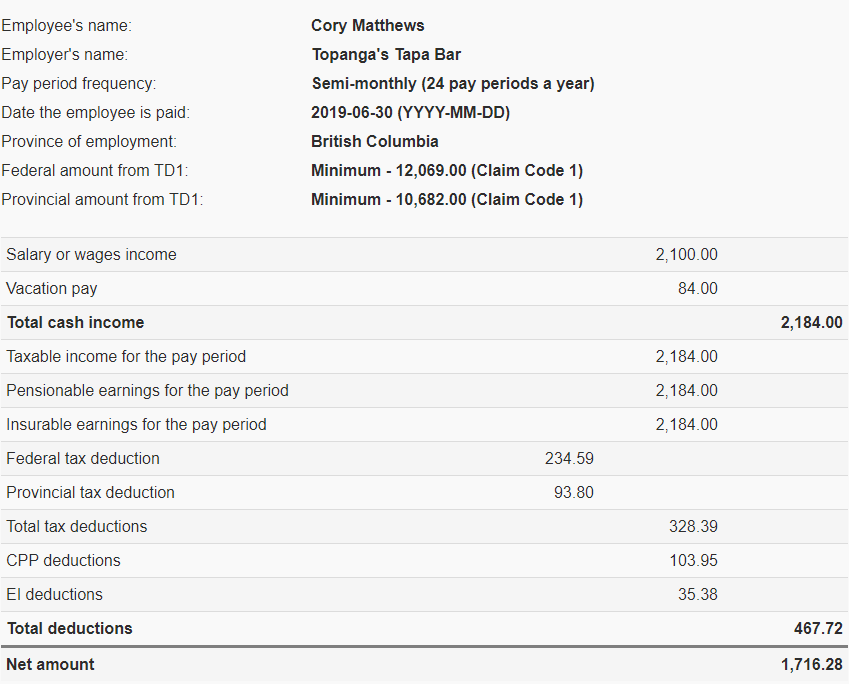

On the Salary calculation andor on the Commission calculation screen go to Step 3 and select the CPP exempt andor EI exempt option before clicking on the Calculate button. Our calculator also includes mortgage default insurance CMHC insurance land transfer tax and property. The amount can be hourly daily weekly monthly or even annual earnings.

To make use of the Alberta child support calculator enter the gross yearly amount of income earned by the paying parent into the first window. If one or both parents live outside Alberta use the Canada Child Support Calculator instead. Line 20700 - RPP Contributions.

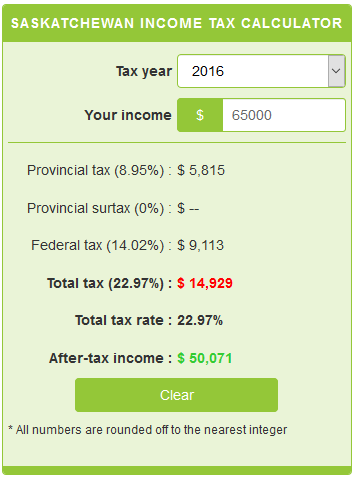

Income for calculating benefits. Enter your pay rate. The calculator is updated with the tax rates of all Canadian provinces and territories.

Line 15000 - Total Income. The default value in the calculator is the 2019 maximum monthly payment regardless of your marital status. The maximum monthly accommodation charge in designated supportive living and long-term care as set by Alberta Health.

Find your average tax rate and how much tax you will have to pay on any additional income. The 2021 Tax Calculator includes Federal and Province tax calculations for all income expense and tax credit scenarios. Compare your monthly free cash flow to that of your spouse ie.

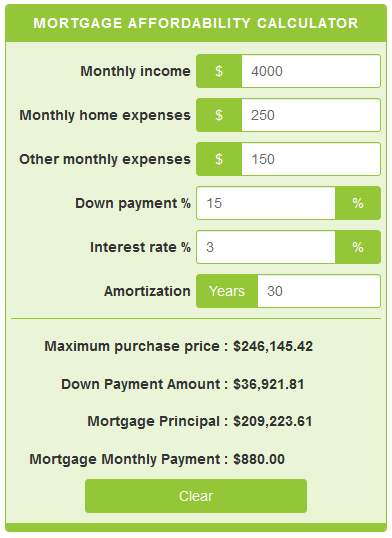

The first affordability guideline as set out by the Canada Mortgage and Housing Corporation CMHC is that your monthly housing costs mortgage principal and interest taxes and heating expenses PITH - should not exceed 32 of your gross household monthly income. Do you want to deduct. You can use the calculator to compare your salaries between 2017 2018 2019 and 2020.

Is this a Canadian retirement income calculator. Minimum gross monthly income 6000. Another way to think of vacancy rate is the amount of time your property is making money which is 100 - Vacancy Rate.

Following which you are to select the number of children involved via the drop-down menu. Line 14500 - Social Assistance. With it youll be able to set up a steady stream of income Top 6 Monthly Dividend Stocks in 2021.

Usage of the Payroll Calculator. Also includes half of your monthly condominium fees. Monthly debt expenses of 600 in addition to the mortgage payment would require a gross monthly income of 6333 or an annual income of.

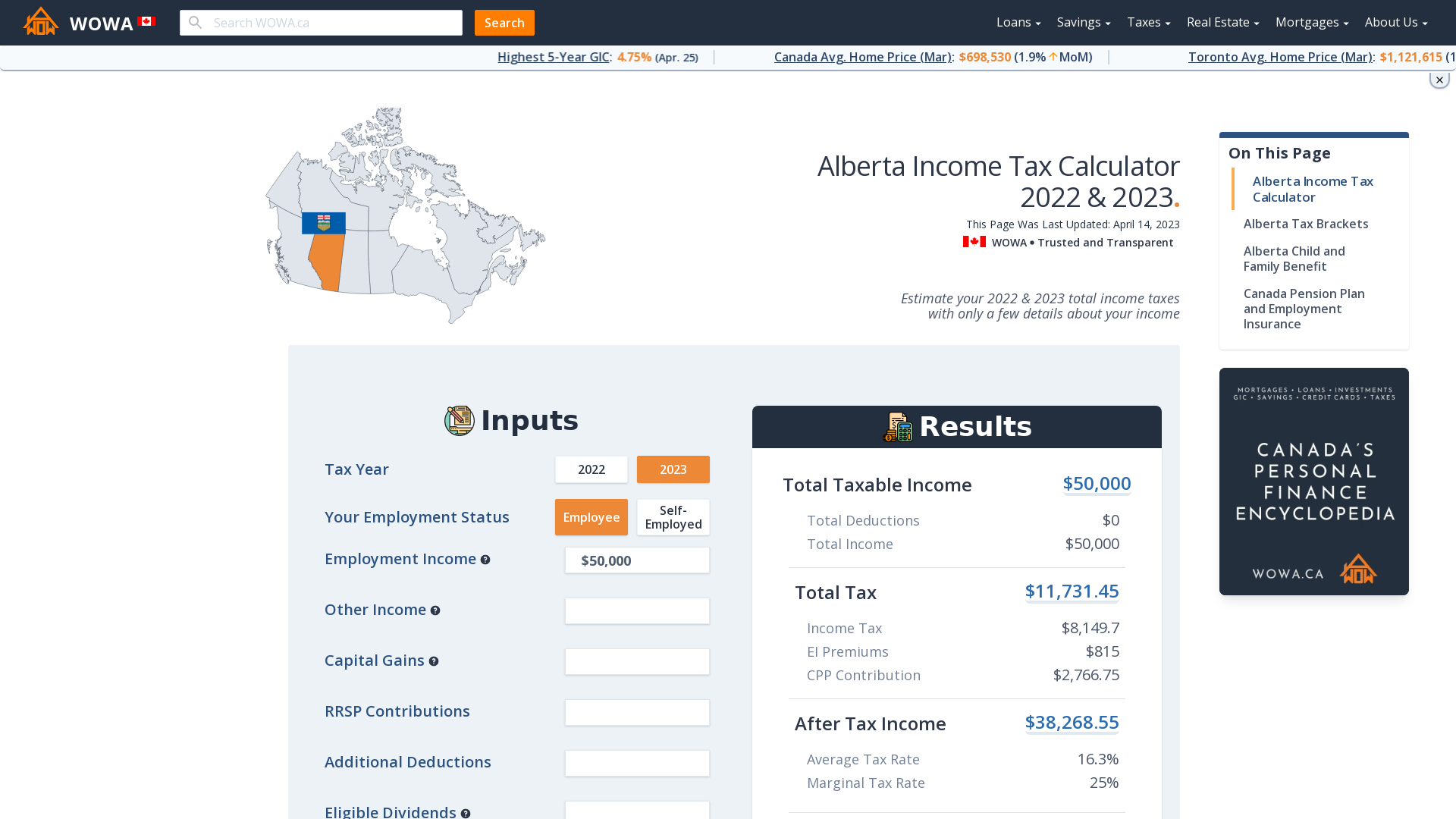

This calculator uses the latest table amounts that. Line 10100 - Employment Income. Estimate your 2020 2021 total income taxes with only a few details about your income and province.

Canada Income Tax Calculator for 2020 2021. Child support for Alberta is calculated using the Federal Child Support Guidelines and the Alberta child support tables. You can check the latest.

Line 14600 - Guaranteed Income Supplement. Calculate CPP EI Federal Tax Provincial Tax and other CRA deductions. One of a suite of free online calculators provided by the team at iCalculator.

Fidelitys tax calculator estimates your year-end tax balance based on your total income and total deductions. Youll need to input how much you extra. The monthly disposable income amount of at least 322 this amount may be used for personal expenses such as personal hygiene telephone cable etc.

The tax calculator is updated yearly once the federal government has released the years income tax rates. The Motley Fool has no position in any of the stocks mentioned. The sum of these.

The calculator helps determine how much you can afford based on your yearly incomealong with the income of anyone else purchasing a home with you and your monthly expenses. Fool contributor Christopher Liew has no position in any stocks mentioned. Updated for 2021 the Canada Tax Return Calculator is a complex yet simple way to estimate your salary and payroll.

Monthly a month 12 periods per year Semimonthly 2 x per month 24 periods per year Biweekly every 2 weeks 26 periods a year weekly once per week 52 periods a year Schedule per hour 52 weeks x number of hours per week Our calculator allows you to evaluate the grossnet salary over the period based on the number of weeks worked that you entered in the field weeks of work. To make the cut paying monthly dividends was just the first hurdle. The Net Rental Income is your Gross Rental Income after taking into account the operating expenses of owning a.

To determine the amount of tax to deduct from income not subject to CPP contributions or EI premiums use the Payroll Deductions Online Calculator available at canadacapdoc. Overall the stocks below give ownership in great businesses. Line 20800 - RRSP Contributions.

WOWA Trusted and Transparent. Once you click calculate the child support calculator Alberta will generate a potential amount of support payments that may have to be made. Child support and goverment benefits.

If your monthly non-housing debts are greater however your total debt payments will exceed 36 of gross income and youll need income to qualify for the mortgage.

Mathematics For Work And Everyday Life

Canada Capital Gains Tax Calculator 2021 Real Estate Stocks Wowa Ca

How Much It Really Costs To Own A Car And Why You Should Care

Mortgage Affordability Calculator Calculatorscanada Ca

2021 Alberta Province Tax Calculator Canada

Home Affordability Calculator For Excel

Alberta Income Tax Calculator Wowa Ca

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

2016 08 05 Applicant Financial Evidence

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

Saskatchewan Income Tax Calculator Calculatorscanada Ca

Rental Property Calculator 2021 Wowa Ca

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

Temporary Wage Subsidy For Employers How To Calc

Top 6 Best Gross Income Pay Calculators 2017 Ranking Annual Income Net Monthly Wage Salary Calculations Advisoryhq

Canada Federal And Provincial Income Tax Calculator Wowa Ca

Top 6 Best Gross Income Pay Calculators 2017 Ranking Annual Income Net Monthly Wage Salary Calculations Advisoryhq

Mortgage Calculator Calculatorscanada Ca

Post a Comment for "Monthly Income Calculator Alberta"