Gross Annual Income Meaning Philippines

Meaning wala ng percentage tax 2551 yung income tax nalang 1701. 1 Compensation for services in whatever form paid including but not limited to fees salaries wages commissions and similar items.

Airline Pilot Salary How Much Will I Earn As A Pilot

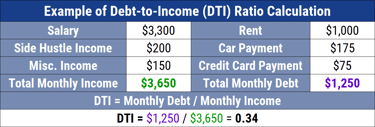

In fact around 20 credit cards are within reach of employees with a modest monthly salary.

Gross annual income meaning philippines. Wages salary overtime pay commissions tips or bonuses before deductions. 61 rows GNI formerly GNP is the sum of value added by all resident producers plus any product. You can have PHP 250000 deduction if you are a purely self-employed andor.

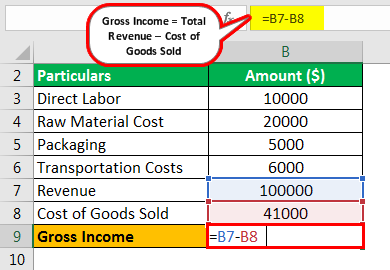

For example if your employer pays you a base salary of 50000 a year and withholds taxes from that amount then 50000 is your gross income. Your gross income is all money you earn during the year before taxes or any other deductions are removed from that total. The gross income for an individual is the amount of money earned before any deductions or taxes are taken out.

Review the full instructions for using the Philippines Salary After Tax Calculators which details Philippines. Gross annual income is the amount of money a person earns in one year before taxes and includes income from all sources. However wala na tong deductions like Itemized or OSD.

Hence Filipino families has savings of 52 thousand pesos in a year on average. The Philippines follows a pay-as-you-file system for income tax so the quarterly and annual income tax payments would fall due on the same filing deadlines discussed above. Under Section 32 A Except when otherwise provided in this Title gross income means all income derived from WHATEVER SOURCE including but not limited to the following items.

Low annual income requirement ranging from PHP 120000 to PHP. Net Salary Gross Salary - Monthly Contributions - Income Tax 25000 - 1600 - 5134 25000 - 21134 228866 Your net-take home pay or net salary would be 228866. In comparison the average annual family expenditure for the same year was 215 thousand pesos.

The Annual Wage Calculator is updated with the latest income tax rates in Philippines for 2019 and is a great calculator for working out your income tax and salary after tax based on a Annual income. Income in Philippines is divided into the following three categories which are taxed separately as summarized below. Typically a credit card for low income earners has the following features.

Real growth of the Philippines annual per capita gross income was below the Asia Pacific average of 42 during the same period mainly due to the countrys sharp economic slowdown in 2009 amidst the global financial crisis of 2008-2009. An individual employed on a full-time basis has their annual salary or wages before tax as their gross income. The average annual household income was approximately 523710 while the average annual household expenditure was 421714.

For the 8 IT rate its pretty easy. The balance of the tax due after deducting the quarterly payments must be paid while the excess may be claimed as a refund or tax credit. An individuals gross annual income is the amount of money made within one year before deductions.

This brings the average. Gross annual income includes. The most typical earning is 335513 PHP.

This income is taxed at progressive rates on gross income after deduction of personal and additional exemptions but without deductions for expenses. The survey results showed that the average annual family income of Filipino families was approximately 267 thousand pesos. Persons who are not VAT-registered who sell goods properties or services whose annual gross sales andor receipts do not exceed three million pesos Php300000000 and are exempt from value-added tax VAT under Section 109 BB of the National Internal Revenue Code as amended by.

The Philippines per capita annual gross income stood at PHP105044 US2366 in 2014 growing at an average annual rate of 32 in real terms since 2009. Its 8 Income Tax on Gross SalesReceipts instead of Graduated IT Rates and Percentage Tax. Excess estimated quarterly income taxes paid may be carried over and credited.

Thats the step by step guide on how you can compute your income tax and get your monthly net salary. The calculator is designed to be used online with mobile desktop and tablet devices. Adjusting for the inflation between 2015 and 2018 at 2012 prices the average annual family income in 2018 would be valued at PhP 267 thousand while the average annual family expenditure for the same year would be valued at PhP 203 thousand Table 1.

While a higher income raises ones chance of getting approved for a credit card it doesnt mean low income earners in the Philippines cant get a credit card. 1 For companies gross income is interchangeable with gross margin or. 45 rows Average salary in Philippines is 856997 PHP per year.

All data are based on 3087 salary surveys. Income Tax is a tax on a persons income emoluments profits arising from property practice of profession conduct of trade or business or on the pertinent items of gross income specified in the Tax Code of 1997 Tax Code as amended less the deductions if any authorized for such types of income by the Tax Code as amended or other special laws. For example when an employer pays you an annual salary of 50000 per year this means you have earned 50000 in gross pay.

However a full-time employee may also have other sources of income that must be considered when calculating their income.

/money-and-graph-954922482-ef6824e995014ec3a75f865385696dce.jpg)

Gross Income Definition Formula Examples

Annual Income Learn How To Calculate Total Annual Income

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Gross Income Definition Formula Examples

Sample Financial Reports Report Templates Annual For School Example Within Quarterly Re Income Statement Profit And Loss Statement Personal Financial Statement

Gross Income Formula Step By Step Calculations

Philippine Monthly Average Salary 2020 Statista

Airline Pilot Salary How Much Will I Earn As A Pilot

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Gross Income Definition How To Calculate Examples

What Is Gross Income For A Business

Philippines Family Income Total By Income Class Ic Annual Economic Indicators Ceic

Annual Income Learn How To Calculate Total Annual Income

Airline Pilot Salary How Much Will I Earn As A Pilot

How Much Is The Good Salary In Japan Quora

Gross Income Formula Step By Step Calculations

15 Faqs Annual Income On Credit Card Applications 2021

Gross Income Formula Step By Step Calculations

Gross Income Formula Step By Step Calculations

Post a Comment for "Gross Annual Income Meaning Philippines"