Annual Salary Withholding Calculator

The salary calculator for income tax deductions based on the latest Australian tax rates for 20212022. Federal Forms W-2 and W-2c reporting Arizona wages andor Arizona income tax withholding and federal Forms W-2G and 1099 reporting Arizona income tax withheld are an integral part of the reconciliation for Arizona Form A1-R Withholding Reconciliation Tax Return and for Arizona Form A1-APR Annual Payment and Withholding Tax Return and must be included with the return.

Excel Formula Income Tax Bracket Calculation Exceljet

Basic GS Net Pay All Locality Grade.

Annual salary withholding calculator. Withholding Annual Increments Of Non-Performers After 20 Years. Follow these simple steps to calculate your salary after tax in Portugal using the Portugal Salary Calculator 2021 which is updated with the 202122 tax tables. Enter your Annual salary and click enter simple.

This number is the gross pay per pay period. Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Georgia paycheck calculator. NextGen Leadership Program Federal Withholding.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. The Federal Tax Tables are subject. Your employer match however is limited to the first 6 of your salary and remains at 750.

There is a widespread perception that increments as well as upward movement in the hierarchy happen as a matter of course. The perception is that grant of MACP although subject to the employee attaining the laid down threshold of performance is taken for granted. 2021 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line.

When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. This calculator is suitable for small and midsize companies. This calculator honours the ATO tax withholding formulas.

The PaycheckCity salary calculator will do the calculating for you. 75000 a year is about 3750 an hour. Did you know that the Medicare Levy increased from 15 to 2 for the 201415 tax year and a Budget Repair Levy of 2 has been introduced on taxable.

Please use the same date format used below. To better compare withholding across counties we assumed a 50000 annual income. Enter decimals with your tax due with no dollar sign.

How to calculate taxes taken out of a paycheck. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. If you have an annual salary of 25000 and contribute 6 your annual contribution is 1500.

West Virginia State Tax Department Business Withholding. We applied relevant deductions and exemptions before calculating income tax withholding. Federal and State Tax calculator for 2021 Annual Tax Calculations with full line by line computations to help you with your tax return in 2021.

45000 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2021 tax return and tax refund calculations. One of a suite of free online calculators provided by the team at iCalculator. How Your Paycheck Works.

Addition to Tax and Interest Calculator Please enter the date your taxes were due the date filed the estimated payment date and the amount owed. What is a 45k after tax. Differences will always be in favour of the ATO however these will be refunded when the annual year tax return is processed.

For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000. How to calculate your salary after tax in Portugal. Important note on the salary paycheck calculator.

If you have a household with two jobs and both pay about the same click this. Refer to employee withholding. Divide your annual salary in half and drop the thousand.

Please use our Advanced Calculator to calculate your net pay or take home pay. To use our Florida Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. See how we can help improve your knowledge of Math Physics Tax Engineering and more.

One of a suite of free online calculators provided by the team at iCalculator. Enter Your Salary and the Portugal Salary Calculator will automatically produce a salary after tax illustration for you simple. Then there is the Federal Tax Tables spreadsheet that provides the details of the IRS Publications that specifies the rules and rates for percentage method tables for withhold amount for an annual payroll period for single person or a married person.

With a 50 match your employer will add another 750 to your 401k account. How to calculate annual income. If you increase your contribution to 10 your annual contribution is 2500 per year.

If you make 60000 a year your hourly salary is approximately 30 an hour. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. We then indexed the paycheck amount for each county to reflect the counties with the lowest withholding.

Instead you fill out Steps 2 3 and 4 Help for Sections 2 -- Extra Withholding because of Multiple Jobs If your household has only one job then just click Exit. Free Federal and State Paycheck Withholding Calculator. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52.

This method of calculating withholding PAYG income tax instalments can vary from the annual tax amounts. 3602450 net salary is 4500000 gross salary. See how we can help improve your knowledge of Math Physics Tax Engineering and more.

70000 or 71477 To view a list of past due dates click here indicates required field. Subtract any deductions and payroll taxes from the gross pay to get net pay. After a few seconds you will be provided with a full breakdown of the tax you are paying.

Individual Development Plan Toolkit. The Australian Salary Calculator includes income tax deductions Medicare Deductions HEPS HELP calculations and age related tax allowances. Dont want to calculate this by hand.

This Commission believes that employees who do not meet the laid. Every employer making payment of any wage or salary subject to the West Virginia personal income tax is required to deduct and withhold the tax from such wages or salaries and remit the tax withheld to the State Tax Department. 2021 Annual Pay w locality 2021 Bi-weekly Pay.

In order to determine an accurate amount on how much tax you. If you make an hourly wage and youd like a more exact number for your annual salary you first need to figure out how. Annual calculations will also differ as tax offsets benefits and deductions are only applied at the end of.

Calculating an Annual Salary from an Hourly Wage.

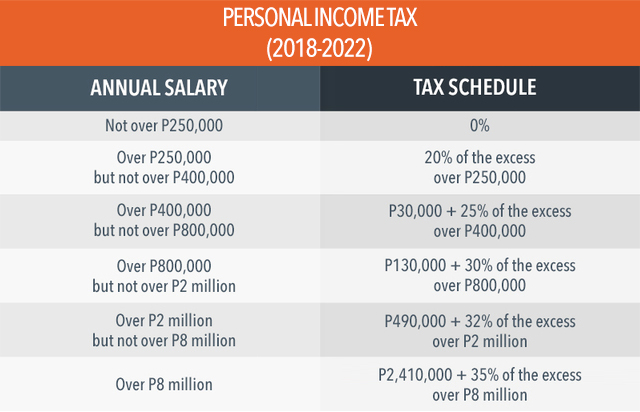

Tax Calculator Compute Your New Income Tax

Paycheck Calculator Take Home Pay Calculator

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Create An Income Tax Calculator In Excel Youtube

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

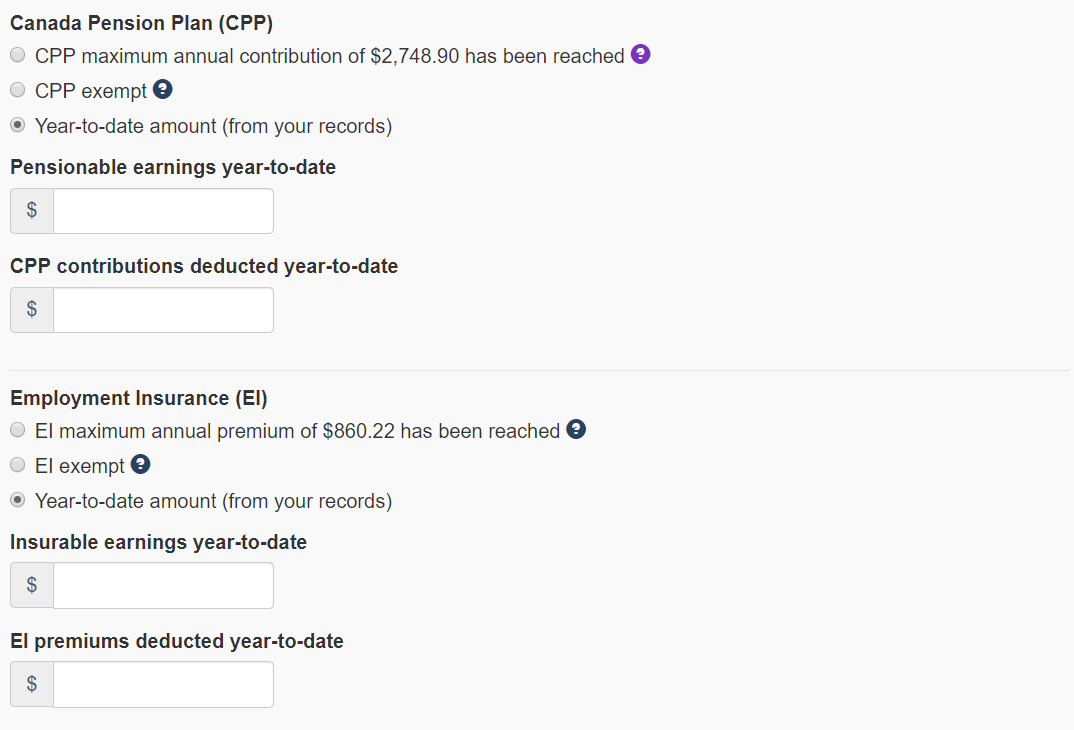

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

How To Calculate Income Tax In Excel

Payroll Tax What It Is How To Calculate It Bench Accounting

Paycheck Calculator Take Home Pay Calculator

How To Calculate Income Tax In Excel

Payroll Calculator Free Employee Payroll Template For Excel

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Top 6 Best Annual Salary Income Calculators 2017 Ranking Yearly Income Calculator To Calculate Annual Salary Advisoryhq

4 Ways To Calculate Annual Salary Wikihow

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Financial Services Platform Salary Tax Calculator 2015

Post a Comment for "Annual Salary Withholding Calculator"